Green Hydrogen Market

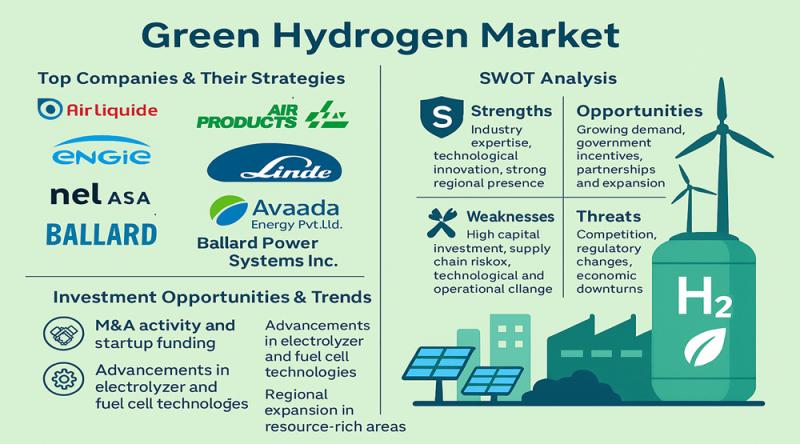

The green hydrogen market is rapidly evolving, driven by global decarbonization goals and advancements in renewable energy technologies. This article delves into the strategies of leading companies, provides a SWOT analysis, and identifies key investment opportunities shaping the market’s trajectory.

Get deeper insights into competitive positioning and strategic benchmarking: Download our sample Green Hydrogen Market report here → https://www.researchnester.com/sample-request-4778

Top Companies & Their Strategies

1.1 Air Liquide S.A.

Air Liquide stands at the forefront of the green hydrogen sector, leveraging its expertise in industrial gases and technology. The company has committed over €1 billion to develop large-scale electrolyser projects in the Netherlands, aiming to produce low-carbon hydrogen using offshore wind energy. These initiatives underscore Air Liquide’s strategy to integrate renewable energy sources into hydrogen production, enhancing sustainability and reducing CO2 emissions.

1.2 Air Products and Chemicals, Inc.

Air Products is a global leader in hydrogen production, known for its extensive infrastructure and supply chain solutions. The company has been actively involved in large-scale hydrogen projects, focusing on liquefaction and transport technologies. Its strategic partnerships and investments position Air Products as a key player in the commercialization of green hydrogen, catering to industries such as refining, chemicals, and transportation.

1.3 Engie S.A.

Engie, a French multinational utility company, has been investing heavily in renewable energy and green hydrogen projects. The company’s strategy includes the development of integrated solutions combining renewable power generation with hydrogen production. Engie’s focus on sustainability and its global presence enable it to play a significant role in the green hydrogen market, particularly in Europe and emerging markets.

1.4 Linde plc

Linde is a leading industrial gas company with a strong presence in the hydrogen sector. The company has been expanding its green hydrogen capabilities through investments in electrolyser technologies and renewable energy projects. Linde’s extensive distribution network and technological expertise position it well to meet the growing demand for green hydrogen across various industries.

1.5 Nel ASA

Norwegian company Nel ASA specializes in hydrogen production technologies, including electrolysis and fueling solutions. Nel’s strategy focuses on scaling up production capacity and reducing costs through technological advancements. The company’s commitment to innovation and its strategic partnerships with major energy companies enhance its position in the green hydrogen market.

Explore detailed profiles of top players and new entrants in this space – access your free sample report →https://www.researchnester.com/sample-request-4778

1.6 Avaada Energy Pvt. Ltd.

Avaada Energy, an Indian renewable energy company, has been expanding into the green hydrogen sector. The company’s strategy involves integrating renewable energy generation with hydrogen production to create a sustainable energy ecosystem. Avaada’s initiatives align with India’s national hydrogen mission, aiming to position the country as a global leader in green hydrogen production.

1.7 Ballard Power Systems Inc.

Ballard Power Systems is renowned for its proton exchange membrane (PEM) fuel cell technology, which is pivotal in the utilization of green hydrogen. The company’s strategy focuses on developing fuel cell solutions for transportation and stationary power applications. Ballard’s technological advancements and partnerships with automotive manufacturers bolster its role in the green hydrogen value chain.

View our Green Hydrogen Market Report Overview here: https://www.researchnester.com/reports/green-hydrogen-market/4778

SWOT Analysis of Leading Companies

2.1 Air Liquide S.A.

• Strengths: Air Liquide’s extensive experience in industrial gases and technology, coupled with significant investments in renewable hydrogen projects, positions it as a leader in the sector. Its global presence and established infrastructure provide a competitive advantage in scaling hydrogen production.

• Weaknesses: The high capital expenditure required for large-scale hydrogen projects poses financial challenges. Additionally, reliance on external renewable energy sources may expose the company to supply chain risks.

• Opportunities: Growing demand for clean energy solutions presents opportunities for Air Liquide to expand its hydrogen offerings. Strategic partnerships and government incentives for renewable energy projects can further enhance growth prospects.

• Threats: Intense competition from other industrial gas companies and technological advancements in alternative energy sources may impact market share. Regulatory changes and policy uncertainties in key markets could also pose challenges.

2.2 Air Products and Chemicals, Inc.

• Strengths: Air Products’ established infrastructure and expertise in hydrogen production and distribution provide a solid foundation for growth. Its involvement in large-scale projects demonstrates capability in executing complex initiatives.

• Weaknesses: The company’s exposure to fluctuating raw material costs and energy prices can affect profitability. Additionally, the capital-intensive nature of hydrogen projects may strain financial resources.

• Opportunities: Expansion into emerging markets and diversification into green hydrogen applications offer avenues for growth. Collaborations with governments and industry players can facilitate project development and implementation.

• Threats: Competitive pressures from both established and emerging players in the hydrogen sector could impact market position. Environmental regulations and shifting energy policies may necessitate operational adjustments.

2.3 Engie S.A.

• Strengths: Engie’s strong portfolio in renewable energy and commitment to sustainability align with the growing emphasis on clean energy solutions. Its global operations enable access to diverse markets and opportunities.

• Weaknesses: The complexity of integrating renewable energy sources with hydrogen production systems may present technical and operational challenges. Market volatility and geopolitical factors could affect project timelines and costs.

• Opportunities: Increasing demand for green hydrogen in various sectors, including transportation and industry, provides growth potential. Policy support for clean energy initiatives can drive investment and development.

• Threats: Competition from other utility companies and energy providers may limit market share. Regulatory changes and economic downturns could impact investment and project viability.

2.4 Linde plc

• Strengths: Linde’s extensive experience in industrial gases and established distribution network offer significant advantages in the hydrogen market. Its technological innovations contribute to efficient hydrogen production and delivery.

• Weaknesses: The capital-intensive nature of hydrogen infrastructure development may pose financial challenges. Dependence on external renewable energy sources could lead to supply chain vulnerabilities.

• Opportunities: Collaborations with automotive and industrial sectors to provide integrated hydrogen solutions present growth opportunities. Expansion into new geographic markets can diversify revenue streams.

• Threats: Technological advancements by competitors and shifts in energy policies may affect market dynamics. Environmental regulations and public perception of hydrogen safety could influence adoption rates.

2.5 Nel ASA

• Strengths: Nel’s focus on electrolysis technology positions it as a key player in green hydrogen production. Its commitment to innovation and scalability enhances its competitive edge.

• Weaknesses: The company’s reliance on external funding for expansion may introduce financial risks. Market competition and technological advancements by rivals could impact market share.

• Opportunities: Increasing demand for clean energy solutions and government incentives for hydrogen projects offer growth prospects. Strategic partnerships can facilitate market entry and expansion.

• Threats: Economic downturns and fluctuations in energy prices may affect project feasibility. Regulatory uncertainties and policy changes in key markets could pose challenges.

2.6 Avaada Energy Pvt. Ltd.

• Strengths: Avaada’s integration of renewable energy generation with hydrogen production aligns with sustainable energy goals. Its initiatives support India’s national hydrogen mission, positioning it as a significant player in the domestic market.

• Weaknesses: The company faces challenges related to infrastructure development and technological integration. Competition from established global players may impact market penetration.

• Opportunities: Government support for clean energy initiatives and the growing demand for green hydrogen present avenues for growth. Expansion into international markets can enhance revenue streams.

• Threats: Regulatory changes and policy uncertainties in the energy sector may affect project timelines and costs. Economic factors and market competition could influence profitability.

2.7 Ballard Power Systems Inc.

• Strengths: Ballard’s expertise in PEM fuel cell technology positions it as a leader in hydrogen-powered applications. Its focus on transportation and stationary power solutions caters to diverse market needs.

• Weaknesses: The high cost of fuel cell technology may limit widespread adoption. Dependence on external suppliers for components could affect production efficiency.

• Opportunities: Collaborations with automotive manufacturers and expansion into new markets offer growth potential. Technological advancements can enhance product performance and competitiveness.

• Threats: Competition from alternative energy technologies and shifts in consumer preferences may impact demand. Regulatory changes and safety concerns related to hydrogen use could influence market acceptance.

Access a complete SWOT breakdown with company-specific scorecards: Claim your sample report → https://www.researchnester.com/sample-request-4778

Investment Opportunities & Trends

3.1 M&A Activity

The green hydrogen sector has witnessed significant mergers and acquisitions, indicating consolidation and strategic positioning. Notably, in Q1 2025, 41 deals were recorded in the hydrogen sector, reflecting increased interest and investment in hydrogen technologies.

3.2 Funding in Startups

Investment in hydrogen startups has been robust, with oil and gas companies increasing their investments in hydrogen startups in the second quarter of 2025, more than tripling the number of deals compared to the same period last year. This trend highlights the growing confidence in hydrogen as a viable energy solution.

3.3 Technology Integration

Advancements in electrolyser technologies and fuel cell systems are central to reducing the cost of green hydrogen production. Companies are investing in research and development to enhance efficiency and scalability, making green hydrogen more competitive with traditional energy sources.

3.4 Regional Expansion

Regions with abundant renewable energy resources are becoming hotspots for green hydrogen projects. For instance, India aims to capture 10% of the global green hydrogen market by 2030, with the government allocating production targets to various companies. This strategic move positions India as a significant player in the global green hydrogen market.

Stay ahead of investment moves in the Green Hydrogen Market- view our analyst-verified insights → https://www.researchnester.com/reports/green-hydrogen-market/4778

Related News:

https://www.researchnester.com/reports/solid-state-car-battery-market/4984

Contact Data

AJ Daniel

Corporate Sales, USA

Research Nester

77 Water Street 8th Floor, New York, 10005

Email: info@researchnester.com

USA Phone: +1 646 586 9123

Europe Phone: +44 203 608 5919

About Research Nester

Research Nester is a one-stop service provider with a client base in more than 50 countries, leading in strategic market research and consulting with an unbiased and unparalleled approach towards helping global industrial players, conglomerates and executives for their future investment while avoiding forthcoming uncertainties. With an out-of-the-box mindset to produce statistical and analytical market research reports, we provide strategic consulting so that our clients can make wise business decisions with clarity while strategizing and planning for their forthcoming needs and succeed in achieving their future endeavors. We believe every business can expand to its new horizon, provided a right guidance at a right time is available through strategic minds.

This release was published on openPR.