Mumbai: India’s recent green hydrogen price discovery through Indian Oil Corporation’s (IOCL) landmark tender has drawn mixed reactions from industry experts, reflecting both optimism about market potential and concerns over long-term competitiveness.

The final price — ₹397/kg which is about $4.67/kg — discovered in the reverse auction process is being seen as a turning point for India’s emerging green hydrogen sector.

India’s bid seen as globally competitive

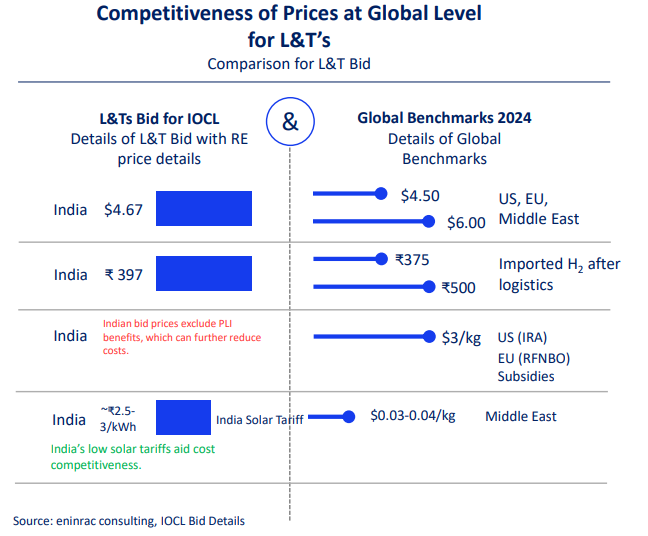

According to Ravi Shekhar, managing director of Eninrac Consulting, L&T’s $4.67/kg green hydrogen bid is globally competitive, lower than EU imports and close to Middle East prices.

“India, led by players like L&T Energy Green Tech, is emerging as a competitive hub for green hydrogen production. With a price of $4.67/kg (₹397/kg), L&T’s hydrogen offering is already aligned with global low-cost producers such as Saudi Arabia and the UAE, whose prices range between $4.50–$6.00/kg,” he said.

He added that when factoring in logistics and import costs, Indian green hydrogen was cheaper than most EU imported hydrogen, which landed at ₹500/kg to ₹600/kg. This cost advantage is further reinforced by India’s ultra-low solar tariffs of ₹2.5 to ₹3 per unit, among the lowest globally, which significantly reduce the cost of electrolysis-based hydrogen production.

However, not all stakeholders are as optimistic.

Green v/s grey

Prashant Vasisht, senior vice-president and co-group head at ICRA, said that the prices discovered recently were in line with current trends and almost double the price of grey hydrogen derived from natural gas and therefore not very competitive.

He said that economics and technology were yet to refine further for green hydrogen to become competitive.

“The price of green hydrogen is still some time away from attaining parity with grey hydrogen. Importantly, renewable electricity prices have to reduce substantially along with the capex of electrolysers among other things for green hydrogen to become competitive,” he said.

In contrast, Nitin Yadav, head of hydrogen – India at Gentari, a clean energy company and a wholly-owned subsidiary of Petronas, called the price discovery a ‘significant milestone’ and said that their initial assessment suggested the prices were ‘quite competitive’.

“The price discovery through the IOCL tender sends a strong signal to project developers that green hydrogen has a viable business case in India. The finalisation of this tender has instilled much-needed confidence in the market and laid the groundwork for scaling the hydrogen economy,” said Yadav.

He added that the price discovery should lead to an increased demand for in-situ green hydrogen projects in India.

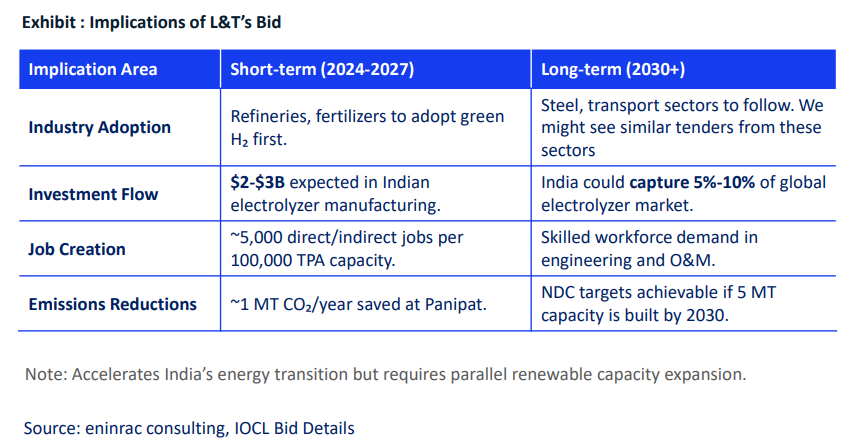

Shekhar said that between 2024 and 2027, early industrial adopters, particularly in refineries and fertilizer production will drive initial demand for green hydrogen.

“This foundational uptake will be critical for de-risking investments, with $2–3 billion expected to flow into domestic electrolyzer manufacturing. By 2030, deeper decarbonization in hard-to-abate sectors like steel and transport will take shape, positioning India to capture 5-10% of the global electrolyzer market,” he added.

Impact on offtake

Regarding impact on offtake, ICRA’s Vasisht added that as prices were significantly higher, offtake agreements would remain limited.

“If we aim for competitive pricing, the offtake must be firm and committed for the full 25-year term,” said Gentari’s Yadav.

He added that there should be more competition in this sector amongst project developers, which would help the green hydrogen ecosystem as well as the consumers.

On offtake, Shekhar added that the Panipat project’s 25-year offtake deal at ₹397/kg with IOCL would secure price certainty and enhance project bankability, setting a credible pricing benchmark for future bids.

With scale-driven efficiencies and larger capacities, prices might fall below ₹350/kg, he added.