Indian steelmakers have begun adopting green hydrogen, but this option should become an even greater priority for the country as metallurgical coal supply risks intensify.

Indian must accelerate its transition toward green hydrogen–based ironmaking and scrap steel recycling to safeguard the long-term energy and materials security of its rapidly expanding steel sector, according to a new report by Institute for Energy Economics and Financial Analysis (IEEFA).

India, the world’s key growth market for steel, is targeting 300 million tonnes per annum (mtpa) of crude steel capacity by 2030. Much of this expansion is planned through blast furnace–basic oxygen furnace (BF–BOF) technology, which relies on high-grade metallurgical (met) coal.

But with domestic coal failing to meet quality requirements, the nation relies on imports, primarily from Australia, for about 90% of its met coal needs. However, Australia’s long-term met coal production is increasingly at risk from financial, legal, regulatory and climate risks, increasing the likelihood that future met coal supply from the country may fall short for India.

“Key risks include growing concern about the methane emissions associated with Australian met coal mining and legal challenges. Coal mine capacity expansions are now being successfully challenged in Australian courts on climate and emissions grounds,” says Simon Nicholas, Lead Analyst, Global Steel at IEEFA and co-author of the report. He added that Australia’s commitment to the Belém Declaration at COP30—calling for a rapid and just transition away from fossil fuels—could accelerate these pressures.

If India continues to develop blast furnaces requiring much more met coal, a supply shortfall could drive significant and structural price increases given the risks associated with developing new supply. The country now faces the urgent need to accelerate the move to alternative steelmaking technologies.

IEEFA’s report highlights green hydrogen and scrap steel as two strategic, domestic resources capable of reducing India’s vulnerability to global coal markets.

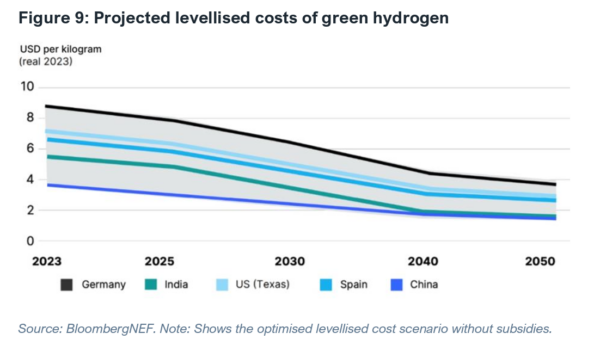

India is among the world’s most promising locations for low-cost green hydrogen production, thanks to abundant solar resources. BloombergNEF forecasts that India and China could be the first countries where green hydrogen costs approach parity with grey hydrogen in the 2030s.

Domestically produced green hydrogen could, therefore, serve as a long-term alternative to met coal in producing direct reduced iron (DRI)— a key raw material used to make steel—strengthening India’s energy security while helping the steel sector decarbonise.

“The combination of scrap-based electric arc furnaces (EAF) expansion, green hydrogen-based steelmaking, and policy incentives for low-carbon technologies could gradually reduce India’s reliance on imported met coal. In doing so, India would not only enhance its energy security but also strengthen its competitiveness in global low-carbon steel markets,” says Saumya Nautiyal, Energy Finance Analyst, Steel at IEEFA and the co-author of the report.

The report states that the focus should be on domestic use of green hydrogen in key industries like steelmaking, rather than export: “Instead of prioritising export, India should focus on domestic use, given the value in terms of energy security and that shipping of green hydrogen and green ammonia is structurally expensive. Green hydrogen use in the steel sector should become an even greater priority for India.”

Indian steelmakers are already preparing for this transition. Jindal Steel plans to begin using green hydrogen at its Angul DRI units in Odisha by late 2025. JSW Steel is piloting green hydrogen in its Vijayanagar plant where JSW Energy has just commissioned a green hydrogen plant and is expanding DRI capacity at its Salav facility in Maharashtra, initially running on methane but designed to switch to green hydrogen as costs decline.

Under the National Green Hydrogen Mission, India aims to produce 5 million tonnes of green hydrogen annually by 2030, although the target may be pushed back by two years.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Popular content