Air Products and Chemicals (APD) just moved deeper into the low carbon ammonia game, entering advanced negotiations with Yara on massive US and Saudi projects that could reshape its long term clean energy revenue mix.

See our latest analysis for Air Products and Chemicals.

Despite these ambitious ammonia and hydrogen projects, Air Products and Chemicals has been under pressure, with a roughly 16 percent 90 day share price return and 20 percent one year total shareholder return both firmly in negative territory. This signals that momentum has been fading even as the long term clean energy story builds.

If projects like Louisiana and NEOM have you thinking about where the next long term winners might emerge, this could be a good time to explore fast growing stocks with high insider ownership.

With the share price sliding despite solid long term project visibility and a double digit discount to analyst targets, the key question now is simple: is Air Products and Chemicals a contrarian buy, or is the market rightly skeptical about future growth?

Most Popular Narrative: 21.3% Undervalued

With Air Products and Chemicals last closing at $243, the most followed narrative places fair value meaningfully higher, suggesting the market is discounting its long term transition story.

Heavy investments in large-scale hydrogen, blue or green ammonia, and carbon capture projects supported by multi decade power and supply agreements in growth regions (e.g., Middle East, Asia, U.S. Gulf Coast) are set to come online over the next several years, providing robust and stable earnings and supporting a trajectory of consistently higher operating margins.

Read the complete narrative.

Curious how much future revenue, earnings power, and margin expansion this narrative is baking in, and which profit multiple it needs to work? The full story lays out the entire math behind that upside.

Result: Fair Value of $308.86 (UNDERVALUED)

Have a read of the narrative in full and understand what’s behind the forecasts.

However, execution missteps on mega hydrogen or ammonia projects, along with prolonged industrial demand weakness, could cap margin expansion and undermine the current undervaluation thesis.

Find out about the key risks to this Air Products and Chemicals narrative.

Another Angle on Valuation

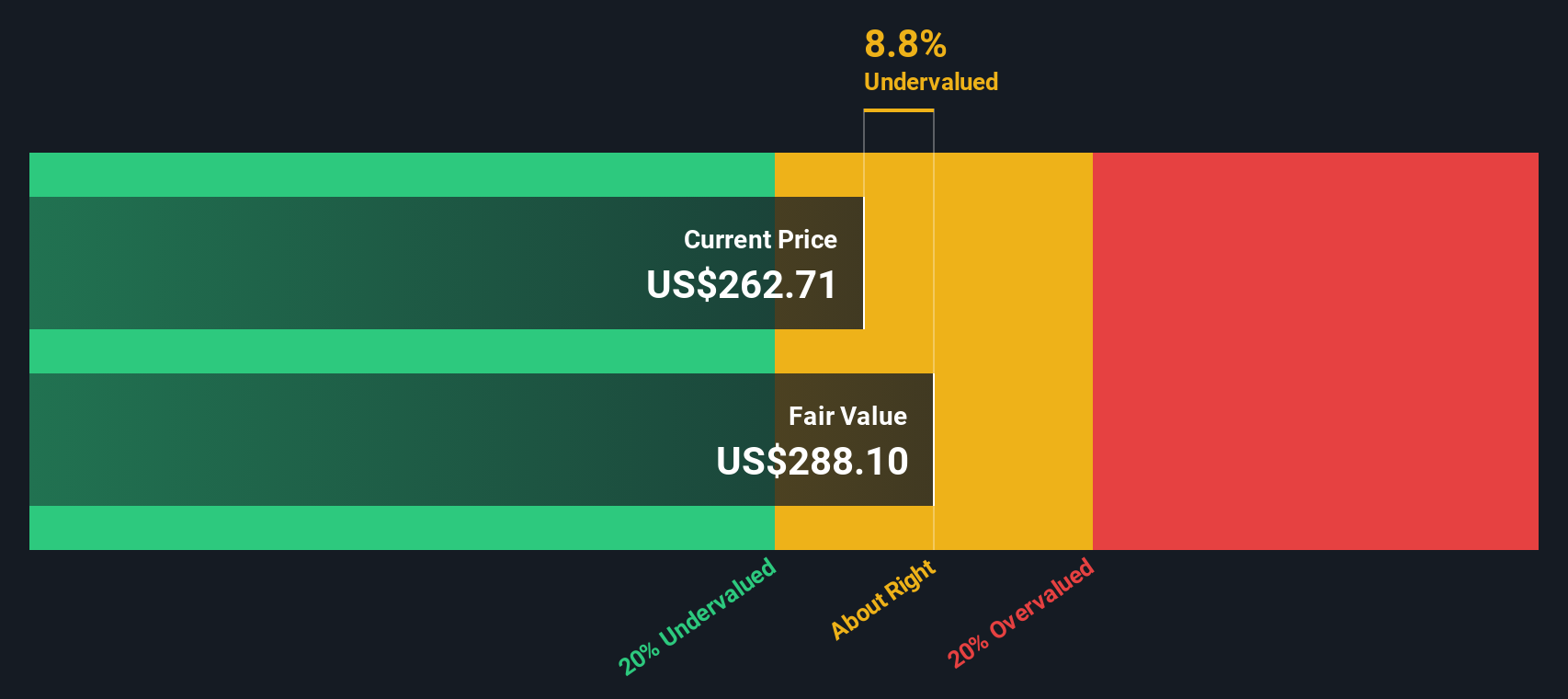

On cash flows, our DCF model paints a softer picture than the narrative fair value. It suggests APD is only about 7.6 percent below its intrinsic value, which implies the margin of safety may be thinner than the 21.3 percent upside story suggests. Which future do you believe?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Air Products and Chemicals Narrative

If you see the numbers differently or want to test your own assumptions, you can quickly build a personalized narrative in just minutes: Do it your way.

A great starting point for your Air Products and Chemicals research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop at a single thesis when the market is packed with potential, use the Simply Wall St Screener to uncover your next smart move today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored Content

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Try a Demo Portfolio for Free

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com