Despite these project announcements, Ameresco has seen mixed momentum across timeframes. The stock has gained around 26% over the past month and is up roughly 23% year-to-date, even after a dip in the last day. However, it remains down about 15% for the year and over 50% below its level three years ago. Recent trading action suggests sentiment may be shifting, as investors reassess how much of this new growth trajectory is factored in.

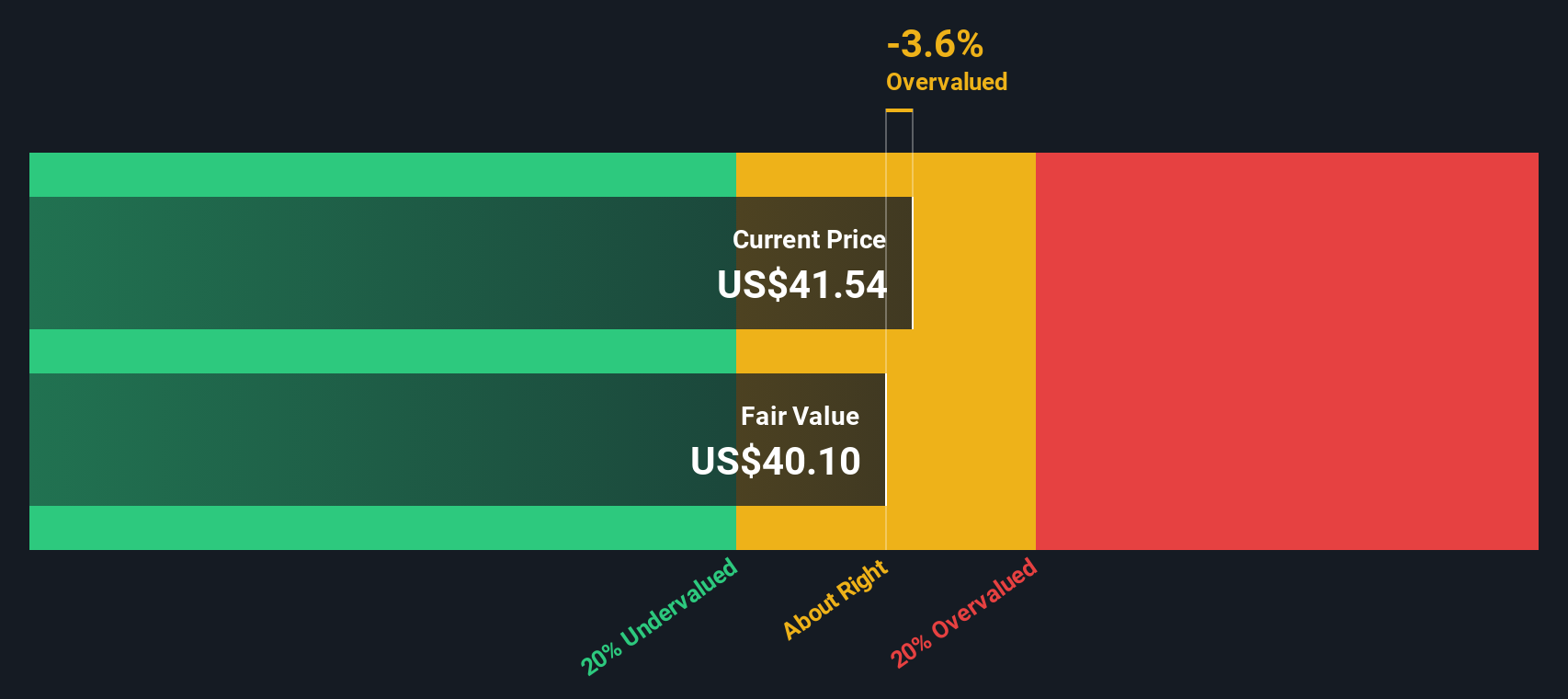

This brings up a key question: does this upswing mark a potential opportunity, or have future gains already been priced in?

Most Popular Narrative: 0.6% Undervalued

The most widely followed narrative currently sees Ameresco as trading just below its estimated fair value, citing recent federal project wins and policy clarity as pivotal tailwinds.

“Strengthened outlook following Ameresco’s agreement to develop a 100 MW AI-optimized data center and critical energy infrastructure at Naval Air Station Lemoore. This highlights its strategic role in federal projects and recognizes Ameresco’s strong positioning within federal government initiatives to expand data centers and power infrastructure on federal land.”

Curious what is fueling this almost exactly fair-priced status? The narrative is underpinned by bold assumptions about future revenue growth, margin enhancement, and a not-so-ordinary profit multiple. Want to know which core financial levers and policy tailwinds are the secret sauce behind this value? Don’t miss the surprising drivers behind this tight valuation call.

Result: Fair Value of $31 (UNDERVALUED)

Have a read of the narrative in full and understand what’s behind the forecasts.

However, persistent supply chain challenges or regulatory shifts could quickly erode Ameresco’s margins and disrupt its path to higher and more predictable growth.

Find out about the key risks to this Ameresco narrative.

Another View: DCF Model Cross-Check

On the other hand, our DCF model takes a closer look at Ameresco’s projected future cash flows to estimate fair value. This approach also indicates the stock is undervalued. However, is this agreement reason to trust the upside?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Ameresco for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match – so you never miss a potential opportunity.

Build Your Own Ameresco Narrative

If this perspective doesn’t speak to you, or you prefer digging into the numbers yourself, creating your own narrative is straightforward and quick. Do it your way.

A great starting point for your Ameresco research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let opportunity pass you by. Simply Wall St puts powerful investment screens at your fingertips, making it easy to spot stocks making real moves right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Try a Demo Portfolio for Free

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com